Which of the Following Business Assets Is Not Depreciated

Dax purchased only one asset during the current year. The asset was depreciated for four years using the straight-line method at 10 per annum.

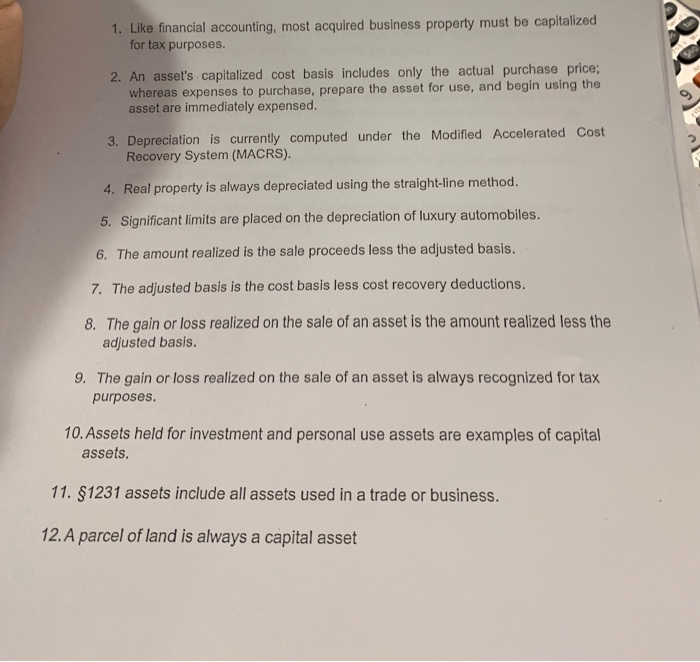

Solved 1 Like Financial Accounting Most Acquired Business Chegg Com

Assets for investment purposes only and not for generating an income LeasedRental property.

. Short-term assets of a business such as cash inventory and receivables are not depreciated in accounting. A fully depreciated asset is an accounting term used to describe an asset that is worth the same as its salvage value Salvage Value Salvage value is the estimated amount that an asset is worth at the end of its useful life. An asset was sold during the year.

The land is classified as real property but it can NOT be depreciated even though it is a business asset. If all assets are not depreciated to the last day of the year depreciation may be overstated in the following year. Paintings Sculpture Art Coins and other collectibles.

Current Assets Cash. An asset can become fully depreciated in two ways. Any personal properties that belong to the owners or employees of the business.

Land is not subject to depreciation. You cannot depreciate property for personal use and assets held for investment. It placed in service equipment 7-year property on September 10 with a basis of 40000.

Which of the following business assets is not depreciated. If an asset is long lived and is used in a productive manner in a business it will be classified as an fixed asset. An example of an asset that is both personal-use and personal property is.

The asset has reached the. Accumulated Depreciation will be credited. Instead they are assumed to be converted to cash within a short period of time typically within one year.

Current assets such as cash in hand receivables. The land is classified as personal-use property and it can NOT be depreciated because it is not a business asset. Which of the following business assets is not depreciated.

Revenues expenses and dividend accounts which are closed at the end of each accounting period are. Calculate the maximum depreciation expense. An office desk is an example of.

Which of the following is not true in regard to selling fixed assets. Personal property Not used for business Leased. Investments such as stocks and bonds.

The work sheet can still have errors even though the columns balance. NOT be depreciated even though it is a business asset. A computer used solely to monitor the CEOs investments and to complete her Form 1040.

The cash receipt is recorded. Current assets such as accounts receivable and inventory are not depreciated. The cost of the asset was 64500.

This message means that the system recognizes an asset that is not fully depreciated to the last day of the fiscal year. The journal entry is similar to discarding fixed assets. The proceeds from the sale of this asset was 38700.

For example land is a non-depreciable fixed asset since its intrinsic value does not change. Which convention is the general rule for intangible property. Which of the following assets is not depreciated.

Assets for personal use. Note This behavior may also occur if an asset has a depreciation method of No Depreciation. Which of the following business assets is not depreciated.

Assets which do not depreciate are. Which of the following fixed assets is not depreciated. Non-depreciable assets also include long-term assets such as.

Examples of non-depreciable assets are. If the selling price is more than the book value a gain is recorded. The land is classified as personal property but it can f.

Personal property and Business property. Salvage value is also known as scrap value. In addition low-cost purchases with a minimal useful life are charged to expense at once rather than being depreciated.

What was the gain or loss on the asset if any. Examples of assets that do not depreciate. Land for site use Nash Co.

Reported a net income for the current year of 120000 cash flow operating activities of 150000 total average assets of 1500000 and paid dividends of 40000. Which of the following plant assets is not depreciated.

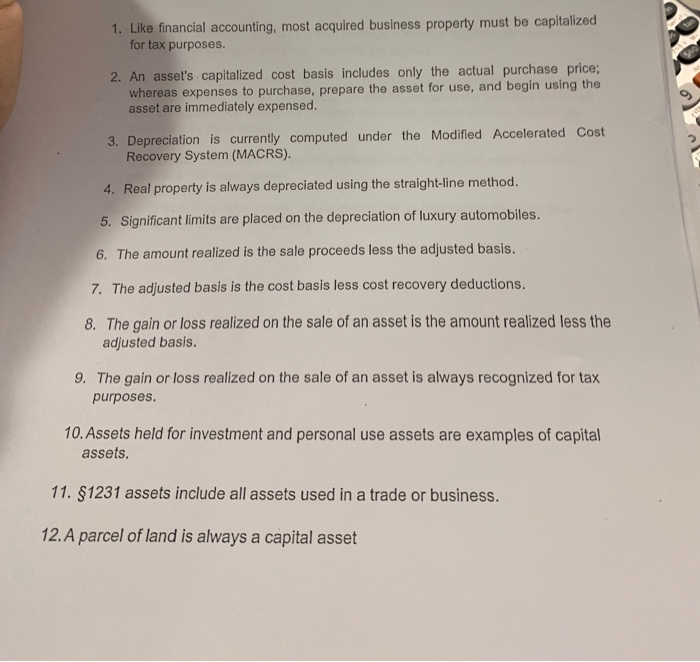

Pdfcoffee Com 11 Partnership Formation Problem 1 Resa 3 Pdf Free

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Business Expense Understanding In A Nutshell

Wages Is A Nominal Real Or A Personal Account Accounting Wage Real

No comments for "Which of the Following Business Assets Is Not Depreciated"

Post a Comment